Core Increases 2024 Advertising Expenditure Forecast to €1.57bn

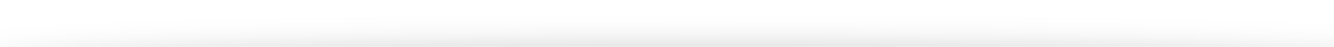

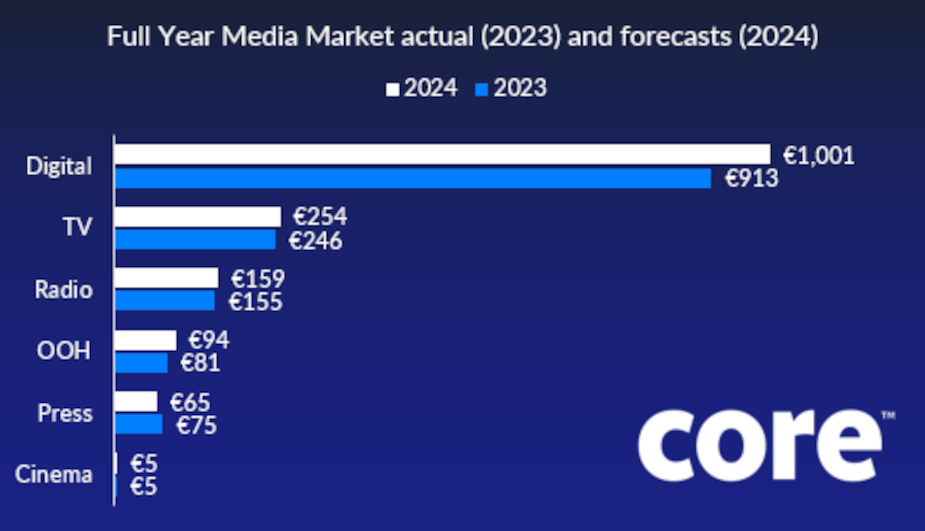

Following a strong first half of 2024, Core, Ireland’s largest marketing communications company, has upwardly revised its full year advertising expenditure forecast from 4.1% to 6.94%.

Earlier this year, Core predicted in their initial Outlook that the market would grow by around 4.1% to €1.472bn. Now, in a Revised Outlook Update, the business is forecasting growth of 6.9% in advertising expenditure to €1.57bn.

The key drivers of this growth include stronger than anticipated performance across digital, particularly driven by increased investment in Online Video and TikTok, Out Of Home (OOH) and TV. According to Core, these channels have performed better than anticipated due to increased investment from categories such as FMCG (Fast Moving Consumer Goods), Retail and Utilities / Telecommunications.

This mirrors global patterns, particularly in the UK, where ad spend has experienced robust growth driven largely by digital investment and overall increased investment across traditional media channels such as OOH and TV.

Video: +4.62% (€291.13 million)

According to Core’s latest report, the business anticipates that video advertising will increase by 4.62% this year to €291.13m. This comes as time spent viewing TV has increased by 1% to year-end July 2024, largely in part to the recent success of the Irish Olympic Team in Paris. Over the summer months, viewership among younger audiences also increased reaching 24% at its peak. Additionally, streams across all broadcast digital players averaged growth of 17%, however, Core predicts this will slow down slightly from September due to less live sport content compared to the same time last year.

Out Of Home (OOH): +16.0% (€93.9 million)

The OOH sector has recovered post pandemic, with significant growth across all formats and sectors including Retail, Media and Food. There has been significant investment by the OOH sector in upgrading sites nationwide, continued investment in digital and securing transport contracts.

Digital: +9.7% (€1,001.4 million)

As reported by tech companies, increased investment in AI has helped revenues in digital grow beyond expectations, with major players including Google, Meta, Amazon and TikTok all reporting significant growth. Advertisers’ key watch out will be growing inflation in some of these platforms to counter changing consumer behaviours, especially as lines begin to blur between search and social for users. TikTok’s long-teased move into long-form video will also be something to watch for, as Core predict it could potentially disrupt video investment.

Audio: +3.39% (€176.35 million)

According to Core, audio investment across radio and partnerships is expected to increase by 2.73%, with the primary drivers in spend being Government, retail and motors. Digital audio is also expected to increase by 10%, however, predictions for this medium have shifted downward versus an initial prediction of 18% growth. This is due to competition in the digital landscape, such as video streaming taking share, and radio continuing to be cost effective whilst delivering strong audience numbers.

Core anticipate that podcasting and streaming will continue to witness strong growth as brands continue to search for incremental reach within the audio landscape.

News Media: -9.44% (94.15 million)

As we enter into the second half of 2024, Core predicts that news content consumption will increase with the US Presidential Election in November and a potential General Election at home in Ireland before the year end. Online outlets are now the main source of news in Ireland for the first time ever, as stated by the latest Reuters Institute Digital News Report. There has been small growth in ad revenue across display / video on news media channels, this, along with potential increased government spending towards the end of the year, will offset some of the decline expected in print.

Cinema: +17.8% (€5.4 million)

Overall, cinema admissions in the year to date are down 8%, but, with the final quarter of the year set to see some larger blockbusters released such as Joker 2 and Gladiator 2, Core expect the industry to have a busy end to the 2024.

Speaking on the revised Outlook Report, Christina Duff, managing director of Core Investment, said, “Towards the end of 2023, the expectations were that 2024 was to be another turbulent year. War in Ukraine and the Middle East were top of the news headlines. Talks were very much focused on a potential recession, while declining interest rates and declining inflation were never far from our minds.

Closer to home there have been some positives. Interest rates were recently cut by the ECB for the first time in two and a half years, inflation fell to a three-year low of 2.2% in June and held this position again in July, and consumer confidence is at its highest level in two and a half years according to the Credit Union Consumer Sentiment Report, in partnership with Core Research.

Although there is a still a sense of caution across the industry, the positive news is that Core evaluates the market as performing stronger than initially predicted. The market has demonstrated even greater resilience, leading us to revise our forecast upwards an anticipate market growth of 6.94%.”